Classified Ads

- Our Customers ***NEEDED RENTAL HOUSES WITH OR WITHOUT BARNS***

Thu Apr 24We have had many calls asking for rentals that are animal-friendly.

If you have any apartments or houses for rent please let us know. We have many people looking for rentals that are good qualified tenants.

Many people are looking for rentals with stalls. We also have customers looking for rentals without stalls that are animal-friendly (dogs or cats).

With rentals, the tenant pays the real estate, not the landlord.

Contact:

631-979-2965

- Condo for Rent $3200 month $900 WEEKLY

Thu Apr 24Condo for Rent $3,200 Monthly or $900 Weekly

Puerto Aventuras Gated Community

Owned by Sharyn Guzzi

2 bedroom 2 bath

on the Marina **Waterfront

Golf, Beach,30 Restaurants, dive shops, Marina, Swim with Dolphins and manatee and snorkel all in one gated community. No covid test in or out of the country. On the Caribbean side of Mexico water is Teal color. On the marina 2 beaches!

Sharyn 631-979-2965

Click Below to view tour of Condo:

https://www.liequine.com/classifieds/index.php?Code=11080&view=virtual

- AGM Solutions -

Wed Apr 24"THE ARENA PROFESSIONALS"

A.G.M. Land Solutions

Installation, Design, Maintenance, Repair, Footing Sales

Contact AGM Land Solutions today to discuss your horse arena construction needs. Let us bring our expertise, dedication, and passion to your project, creating a space where you and your equine companions can thrive. Trust us to turn your dreams into reality, one hoofbeat at a time.

Visit our website at: www.agmlandsolutions.com

CALL TODAY 631-237-0076

- Kent Animal Shelter -

Wed Apr 24www.kentanimalshelter.com

Stay with me and take a few minutes to read this story, it's the greatest story I ever told.

Pam Green and Frodo

11 years ago, Kent Animal Shelter was on the receiving end of a puppy mill rescue operation. On that transport, 160 dogs were rescued from a puppy mill in Missouri. Frodo, as I later named him, was one of the rescues that arrived at Kent, a 5 year old chihuahua/dachshund or "Chiweenie" as they are called. Frodo was very sick with a viral infection and quite underweight so he spent the first month of his arrival in my office as he was treated for his multiple medical issues. Frodo became one the greatest joys of my life and accompanied me to work every day for many years. He imprinted on me from the very beginning, following me everywhere at home and waiting faithfully at the door when I ventured out. Frodo was a tough little guy, hiking many miles with my husband and I and always the boss when big dogs were around. Even after he was diagnosed with congestive heart failure, he managed to live an additional three years, of course, with diligent medical care and lots of love. Recently, on July 10th, Frodo passed away at the age of 16 yrs. What happened next was truly a miracle. My husband and I were away on a yearly bicycle trip. I had gotten a call from Frodo's pet sitter two days after we left that he was having some type of medical crisis. The pet sitter immediately took him to my veterinarian who diagnosed Frodo with having a probable blood clot as he lost all feeling in his legs. We were devastated. There was no choice but to be put him to sleep. The group that we had been traveling with went on the bike ride that was scheduled for that day. My husband and I, very distraught, stayed back at our cabin. A couple of hours later, we decided to take the bicycle ride by ourselves up to a summit pass where there was a small observatory built out of rock. All the way up to the summit, I kept saying over and over in my mind, please, send me a sign that you are okay, that you are still with me, send me a little dog, send me something. We climbed up to the observatory and my husband went inside. There were only a handful of people there that day. A young couple came walking past me with a small dog, a chihuahua mix just like Frodo. Suddenly, the woman said, "C'mon Frodo!" I turned in their direction and said, "What did you just call him?" The woman responded, "His name is Frodo", we named him after the main character in 'Lord of the Rings' which is exactly where we got the name for our little Frodo. I immediately called my husband over and told him the little dog's name was Frodo. The couple are forest fire fighters and were just passing through the area. We told them what had happened just a couple of hours earlier. We were all awe struck as we reveled together in this "miracle story" that happened the day Frodo passed. We were convinced that this could not be a chance meeting or a coincidence. For the past 35 years, as Kent shelter director, I never encountered another dog named Frodo. And there it was, a sign that all was good and Frodo's spirit will live on forever. If you don't believe that there is something else after this life, I can tell you I am sure that there is 100%.

We gave Frodo the best life that he so deserved and he changed our lives forever. Your support of Kent Animal Shelter made that rescue possible. For every animal that comes to Kent in need of a second chance, a life is saved, and the human/animal bonds created are priceless. I ask you now to consider a gift of any amount to help Kent in its rescue efforts to give a second chance to the many animals in crisis situations.

Donate “In Memory of Frodo”, he was truly one of the greatest joys of my life.

MAKE AN EMERGENCY GIFT TODAY in memory of "Frodo" to the 2023 Rescue Campaign so that many more animals in crisis can have a second chance.

The many faces of Frodo

10 Lives Saved from a Sad Ending

Starry Blaze Airport Arrival

Brad Brandon Brittany Bradley

Brad Brandon Brittany Bradley

Click on LOVE to download your application to adopt unconditional love!

By supporting Kent's rescues who were suffering from homelessness, abandonment, hoarding situations, natural disasters and neglect. Without you, they would have met an early demise. Today they are giving unconditional love to an individual or a family and changing their lives So thank you so much from the bottom of our hearts to the tip of their tails for your kindness and generosity in making all of our rescue efforts possible.

*All animals at the Kent Animal Shelter are vaccinated, spayed or neutered before leaving the shelter, tested for tick borne disease, heartworm disease, Feline Aids/Leukemia, micro-chipped. All received veterinary care.

DONATE!

ADOPT!

https://www.kentanimalshelter.com/adoption-application-form

Please click on the video link below that reflects on the work of the shelter in 2022 that tells the stories of some of the homeless animals that were given a path out of harm's way through your generosity and support.

Please consider becoming a SPONSOR with a small monthly contribution to help provide medical care to rescued animals until forever homes can be found. Or a one-time DONATION to help Kent rescue more animals in crisis situations.

Are you foster material? Maybe you can't make a permanent commitment but you want to temporarily help a homeless dog or cat. Please contact us if you are interested. You can even choose the pet you foster! pamgreen@kentanimalshelter.com

Your Vehicle donation can help save the lives of homeless animals. Call today!

Visit us on Facebook!

www.facebook.com/kentanimalshelter

We are located at:

2259 River Rd, Calverton, NY 11933

631-727-5731

www.kentanimalshelter.com

ADOPTION CENTER: Open 7 days a week, 10am-4pm

CLINIC: Low cost spay/neuter and vaccinations, by appointment only

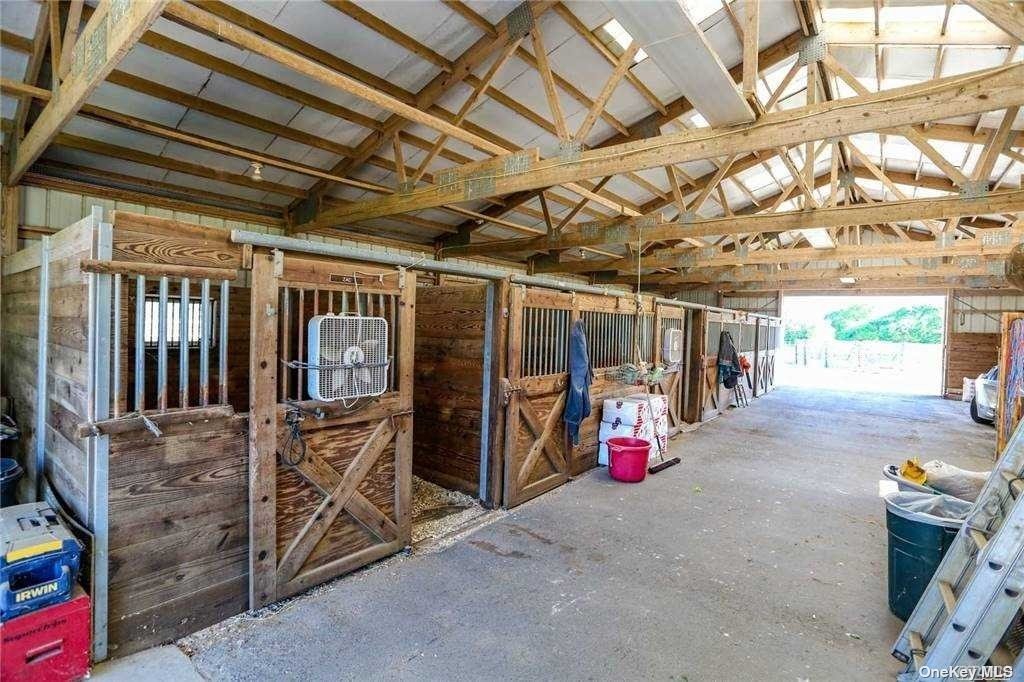

Baiting Hollow $1,900,000

Wed Apr 24

Has Barn

Has Barn

- AIKEN SC

Tue Apr 24

- LI EQUINE Price Chart

Tue Apr 24

Horses Advertisements:

$50 for two months

$70 for three months

$90 for four months

Business Classifieds:

(Tack Shops, Veterinarians, Hay & Feed Supplies, Farriers, Equine Services, Equine Products)

$35 for one month

$90 for three months

$150 for six months

$260 for twelve months

Item/Employment:

$30 for one month

$55 for two months

$150 for six months

Editing of Changing Any Ads: $5

One Time Fee For Links (Including Youtube Links For Horses): $10

Items That Are Under $100 Dollars Can Be Placed In The Bargain Barn Section Of The Message Boards.

Please Do Not Hesitate To Contact Our Office To Assist You With Placing, Renewing, Or Changing Your Ad!

631-979-2965

CLICK HERE TO ADVERTISE WITH US

- Magic Kindoms Great Danes .. this is one of them

Tue Apr 24Magic Kingdoms Great Danes

BELOW IS OUR WEBSITE:

https://magickingdomsdanes.net

FACEBOOK:

https://www.facebook.com/MagicKingdomsGreatDanes/

(631) 902-7750

Sloth Encounters

Tue Apr 24https://www.slothencounters.com